By Tunbosun Olaoye

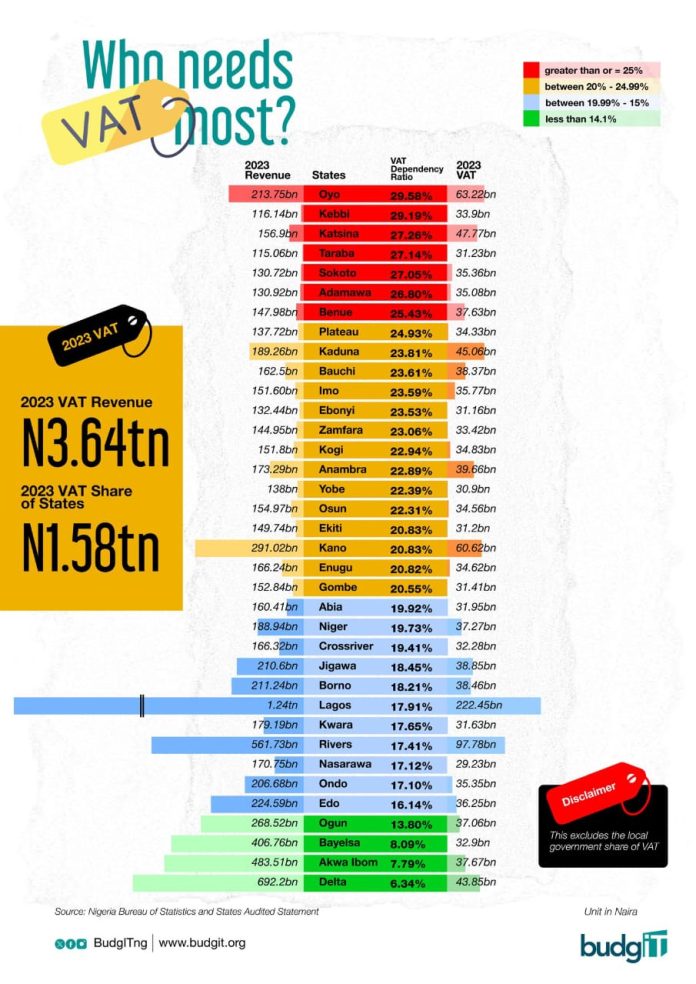

A closer look at Nigeria’s 2023 revenue data reveals that seven states—Oyo, Kebbi, Katsina, Taraba, Sokoto, Adamawa, and Benue—relied on Value Added Tax (VAT) for over 25% of their total revenue, emphasizing the heavy dependency on federal tax allocation in parts of the country.

Additionally, 14 other states depended on VAT for between 20% and 24.99% of their revenue, while 11 states recorded VAT contributions ranging from 15% to 19%.

Only four states maintained minimal reliance, with VAT accounting for less than 14% of their revenue.

The statistics highlight a significant disparity in fiscal independence among Nigerian states, with many still struggling to generate adequate internal revenue. States with high VAT reliance often grapple with financial shortfalls, underscoring the urgency of diversifying revenue sources.

As Nigeria pursues tax reforms aimed at broadening its fiscal base, states heavily reliant on VAT face the challenge of enhancing internally generated revenue (IGR). Strategic initiatives such as investment in infrastructure, incentivizing local industries, and optimizing tax administration could play a pivotal role in reducing federal dependency.

The VAT dependency trend raises critical questions about fiscal sustainability and the need for states to secure long-term economic stability in the face of evolving tax policies.