By Niyi Jacobs

The National Insurance Commission (NAICOM) has revealed a significant 72% quarter-on-quarter (QoQ) growth in the insurance sector’s gross premium income, which surged to ₦813.1 billion in Q2 2024, up from ₦470.7 billion in Q1 2024. Year-on-year (YoY), the sector recorded a 47.4% increase compared to Q2 2023, underscoring the industry’s resilience amidst challenging macroeconomic conditions.

NAICOM’s bulletin highlighted that the insurance market remained profitable in Q2 2024, with an average net loss ratio of 55.5%, slightly higher than the 52.9% recorded in Q1 2024. While the non-life segment had a net loss ratio of 57.2%, the life segment showed an improved ratio of 53.6%. Despite individual underwriters facing challenges, the overall sector profitability remained intact.

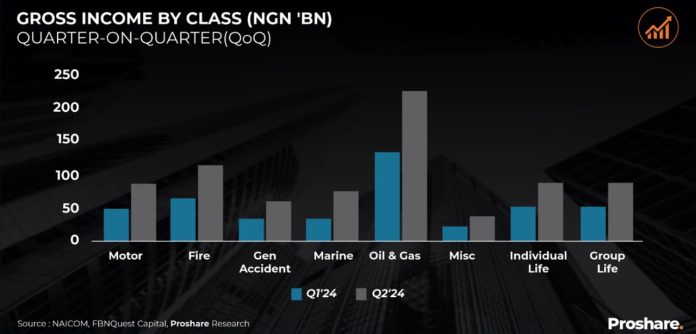

In the life insurance segment, Group Life emerged as the leading premium generator, contributing 35.8% of gross premiums, while the annuity business accounted for 29.7%. In the non-life segment, the oil and gas sector dominated, contributing 39.2% of gross premiums, followed by fire (17.5%), motor (15.5%), and marine/aviation (12.5%).

The sector’s gross claims totaled ₦297.9 billion, representing 36.6% of gross premium income, while net claims stood at ₦259.4 billion, amounting to 87.1% of all gross claims.

The report also highlighted a 9.5% QoQ growth in total assets, which reached ₦3.69 trillion in Q2 2024. The non-life business accounted for ₦2.29 trillion, with the life business contributing ₦1.39 trillion.

Market concentration remained notable, with the top three life insurance companies holding 43.8% of total life premiums, and the top three non-life companies accounting for 34.8% of the market share.

This robust performance emphasizes the insurance sector’s potential as a key driver of economic stability and growth.