by Abiodun JIMOH

Stanbic IBTC Holdings Engages Shareholders on Strategic Vision, Financial Strength at 13th AGM

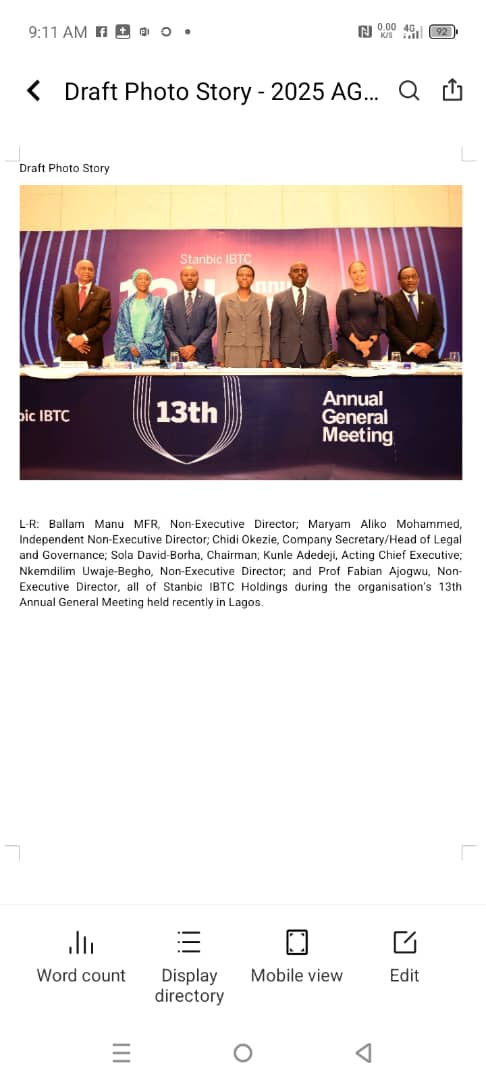

Stanbic IBTC Holdings PLC, a member of the Standard Bank Group, held its 13th Annual General Meeting (AGM), presenting shareholders with its audited financial statements for the year ended December 31, 2024. The meeting reflected a year of robust performance, strategic progress, and strong shareholder returns.

The Group reported a 78.26% rise in net interest income to ₦823.31 billion from ₦461.86 billion in 2023. This powered a profit before tax of ₦303.80 billion and a profit after tax of ₦225.31 billion—a 60.23% increase year-on-year. Earnings per share stood at 1,710 kobo, while the Board proposed a final dividend of 300 kobo per ordinary share, bringing total dividend payout for 2024 to 500 kobo.

Chairman Sola David-Borha commended the Group’s resilience in the face of economic uncertainty, highlighting progress across strategic priorities. “We are proud to report strong progress as Nigeria’s leading end-to-end financial services provider,” she said. “For the fourth consecutive year, our SME and retail banking businesses were ranked first in the KPMG Nigeria Banking Industry Customer Experience Survey—proof of our customer-first culture and service excellence.”

She emphasized the Group’s continued investments in digital innovation, expanded product offerings, and deepened strategic partnerships to meet evolving customer needs.

Acting Chief Executive Adekunle Adedeji credited the Group’s performance to operational discipline, innovation, and a strengthened organizational culture. “Beyond the strong numbers, we streamlined operations through digital transformation, embedded sustainability, and deepened our customer-first mindset,” he noted.

Looking ahead, Stanbic IBTC reaffirmed its commitment to national development, pledging support for financial inclusion, youth empowerment, and entrepreneurial growth. The Group will continue to align with the Sustainable Development Goals (SDGs) and embed ESG principles into its strategy.

Despite macroeconomic headwinds, Stanbic IBTC expressed optimism about future growth, anchored on operational excellence, enhanced customer experience, and digital leadership—cementing its place as a pacesetter in Nigeria’s financial services landscape.