By NIyi Jacobs

Nigeria’s banking recapitalisation push is gaining traction as investors pour billions into lenders racing to meet the Central Bank of Nigeria’s (CBN) new capital thresholds.

Investor enthusiasm is driving the momentum, with strong oversubscription rates across multiple rights issues and public offers. Analysts at BusinessNG note that this wave of confidence points to growing trust in the sector’s long-term potential and institutional strength.

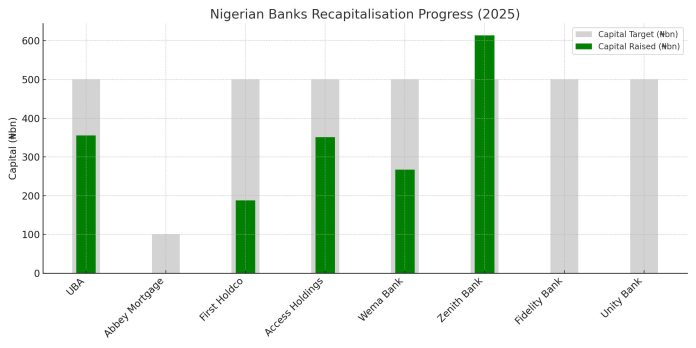

Access Holdings leads the charge, raising N351 billion from a rights issue of over 17.7 billion ordinary shares at N19.75 each—making it the first institution to meet the CBN’s N500 billion capital requirement for international banks.

United Bank for Africa (UBA) followed closely with a N251 billion rights issue that was oversubscribed. Although the bank could only take up N240 billion in this tranche, it has raised its capital base to N355.2 billion. The remaining N144.8 billion will be raised later this year. Significantly, Group Chairman Tony Elumelu personally acquired over 1.27 billion shares valued at N43.91 billion—an insider vote of confidence.

Zenith Bank has also surged ahead, reporting a new share capital of N614 billion after a 160% subscription to its combined rights and public offers. Investors responded with enthusiasm, reinforcing the bank’s market strength.

Wema Bank is in its final stretch. Its rights issue of over 14.2 billion shares closed in May, and Managing Director Moruf Oseni announced at the AGM that the bank has met the recapitalisation requirement, pending CBN verification. A new N50 billion raise is expected soon, which could boost its capital to about N267 billion.

Fidelity Bank is entering the second phase of its recapitalisation, having secured CBN approval for a private placement set to launch in the second half of 2025.

Elsewhere, Abbey Mortgage Bank is gearing up to raise N100 billion to meet the N50 billion threshold for a transition into a regional commercial bank. The board has approved a rights issue, public offering, or other financial instruments to get there.

First HoldCo is preparing for a N350 billion private placement after its N150 billion rights issue attracted a 25% oversubscription, raising N187.6 billion. The group remains confident in meeting the capital target.

One outlier is Unity Bank, which has yet to disclose the status of its recapitalisation plan. However, a potential business combination with Providus Bank is being discussed as a pathway to compliance.

The recapitalisation wave, while regulatory in origin, is now clearly investor-driven. Analysts say the level of participation indicates more than just compliance—it signals renewed confidence in Nigerian banks as engines of future growth.

With more private placements and second tranches in the pipeline, the coming months will be decisive in determining how quickly and broadly the sector reaches full recapitalisation.