NIyi Jacobs

Ecobank Transnational Incorporated (ETI) has emerged as Nigeria’s highest-ranked tier 1 bank in the 2025 edition of the BusinessNG Tier 1 Banks Report, overtaking long-time leader Zenith Bank.

The shake-up reflects the ongoing transformation of the Nigerian banking landscape, driven by a new wave of recapitalisation and the changing demands of increasingly sophisticated customers.

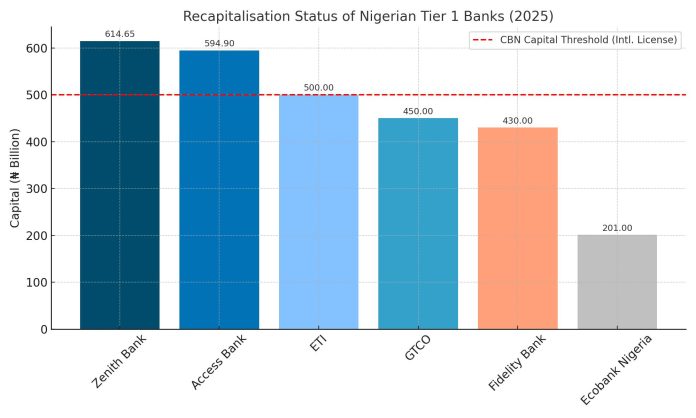

According to BusinessNG, ETI’s impressive 67.11% asset growth—mainly from its operations across Francophone West Africa and select Anglophone countries outside Nigeria—played a major role in its ascension. Interestingly, the group’s Nigerian subsidiary, Ecobank Nigeria, has opted to retain a national license, meeting the CBN’s lower recapitalisation threshold of N200 billion with N201 billion in common equity tier 1 capital.

Meanwhile, Zenith Bank and Access Holdings, both of which hold international licenses, have already surpassed the Central Bank of Nigeria’s new capital requirement of N500 billion. Zenith’s capital now stands at N614.65 billion, while Access Bank follows closely with N594.90 billion. GTCO and Fidelity Bank are in advanced stages of recapitalisation, positioning themselves to cross the same benchmark before the 2026 deadline.

Fidelity Bank’s journey is particularly notable. It had briefly broken into the tier 1 league in the inaugural edition of the BusinessNG report but slipped out in subsequent years. Now, with aggressive capital raising efforts and an eye on regional competitiveness, the bank is forecast to reclaim its tier 1 status by financial year end 2025—despite facing a recent Supreme Court ruling that imposed a N225 billion judgment debt over a legacy issue involving the defunct FSB International Bank.

The BusinessNG report, now in its first edition, notes that while Nigeria’s top banks have largely remained the same since 2020, their internal rankings are shifting as some players reposition for regional relevance and global investor confidence.

The methodology for this year’s report remained consistent with the third edition to ensure comparability, following a major revision in 2022 when inputs from bank CFOs and risk managers helped refine key performance metrics.

Beyond recapitalisation, the report highlights a broader transformation in banking strategy. Today’s customers demand more bespoke financial services, digital ease, and operational transparency—forcing banks to move away from rigid service structures. The report notes that this shift in customer expectations has become as important as regulatory compliance in shaping long-term bank performance.

The BusinessNG analysis also warns that Nigerian banks remain relatively weak in leveraging off-balance sheet instruments, an area where global banks have excelled in recent years. By failing to optimize these tools, Nigerian banks may be leaving significant value untapped.

On the global front, BusinessNG draws attention to mounting geopolitical uncertainties, including the U.S.–China economic decoupling and revived tariff regimes under former President Donald Trump. These developments are driving international fund managers to rebalance portfolios away from the dollar and into alternative assets like gold, Samurai bonds, and non-dollar real estate, with ripple effects expected to reach emerging markets like Nigeria.

As Nigerian banks push through this period of capital expansion and strategic repositioning, the 2025 BusinessNG Tier 1 Report makes one thing clear: the winners of tomorrow will be those who not only meet regulatory benchmarks but also adapt quickly to changing global financial flows and increasingly demanding local customers