By NIyi JACOBS

If your investment fails to outpace inflation, you’re effectively bleeding money. In Nigeria’s high-stakes environment today, the inflation bar is set exceptionally high. With the benchmark interest rate still at 27.5 percent and inflation hovering around 22.22 percent, investors face a difficult terrain—where even risk-free instruments offer relatively high yields and potentially positive real returns, while riskier assets like equities or cryptocurrency promise soaring returns, but come with heightened volatility.

Money market and government-backed fixed-income instruments remain the sanctuary for conservative investors, offering predictable returns with medium to low risk. Meanwhile, dollar funds provide a hedge against currency devaluation, and more volatile investments like equities, commodities, and cryptocurrencies offer potentially higher returns, albeit with greater risk. The question investors should ask is no longer “What will this yield?” but “Will it beat inflation with acceptable risk?”

Analysts and portfolio managers consistently advocate for a balanced, diversified portfolio—one tailored to individual goals and risk appetite, not just chasing headline returns. The aim is to maximize what’s known as the Sharpe ratio: the extra return you get for each unit of risk taken. In simpler terms, it’s less about gross return and more about how smart the return is, risk-adjusted.

Consider how various asset classes are performing, their outlooks, associated risks, and how each might fit smartly into a well-constructed portfolio.

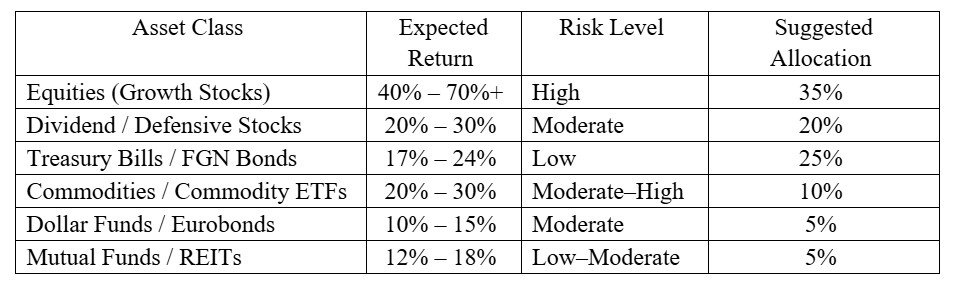

Equities continue to be a compelling play for long‑term investors seeking to outpace inflation. In 2024, the Nigerian Exchange (NGX) demonstrated remarkable resilience, with the All-Share Index (ASI) posting a year‑to‑date gain of 37.65 percent—comfortably outperforming inflation. Around 35 stocks registered triple-digit returns, and about 70 stocks beat inflation in headline returns. Fast‑forward to 2025 and the story gets more impressive: by the end of July, at least 17 NGX-listed companies reached billion-dollar market capitalizations, totaling over $45.15 billion (about N69.978 trillion), up by $11.7 billion (N18.2 trillion) in just seven months. Many of these stocks were deeply undervalued at the beginning of the year and benefited from currency devaluation, making them cheaper for dollar-based investors, while corporate earnings improved across the board.

Speaking on the momentum, Arnold A. Dublin-Green, CIO at Cordros Asset Management, described the situation not as a mere rally but as “a massive opportunity—one of the most compelling contrarian bets in global markets today.” Samson Esemuede of Zrosk Capital echoed the sentiment: “What we’re seeing in the equities market isn’t just a rally—it’s a recalibration.” Institutional participation remains relatively light; pension funds allocate just 11.4 percent of their N24.1 trillion in assets to local equities, and mutual funds dedicate under 2 percent to equity or balanced funds. His tongue-in-cheek advice was simple: “Just reallocate 5 percent of the N3.1 trillion sitting in money market funds into equities—and see the difference.”

For a growth‑oriented investor with a long-term horizon and tolerance for volatility, equities could reasonably account for 20 to 30 percent of a portfolio.

At the same time, Treasury bills, bonds, and fixed income instruments offer attractive sanctuary to defensive investors. Despite their lower capital growth potential, they provide stability and near-zero credit risk. Still, retail investors are increasingly squeezed out of auctions by institutional players and banks. According to the Central Bank’s June 2025 auction data, 91-day T-bills yield 17.80 percent; 182-day bills around 18.35 percent; 364-day bills 18.84 percent. Ten-year Federal Government Bonds are yielding between 13.90 and 14.70 percent, while 15‑year paper goes for about 15.40 percent. Open Market Operation (OMO) bills offer even higher yields—23.70 percent for 204-day maturities and 24.30 percent for 102-day maturities. Despite these nominal yields, real returns remain slightly negative given persistently high inflation, though many analysts believe it’s better to lock in 18—24 percent with minimal risk rather than chase volatile alpha. As Bismarck Rewane, CEO of Financial Derivatives Company, succinctly put it: “If you’re not chasing alpha, the best play is to earn 18‑24 percent with minimal risk and go to sleep.” A conservative allocation suggestion would be around 30 to 40 percent into government fixed income.

For retail accessibility, consider alternatives like FGN Savings Bonds, money market funds, or fixed-income mutual funds. These provide easier access to competitive yields without the friction of auction participation.

Mutual funds offer a professionally managed approach to diversification across asset classes—equity, fixed income, real estate, money market, and dollar-denominated funds. Money market mutual funds remain dominant with a NAV of about N2.77 trillion as of April 2025, delivering capital preservation and yield. A case in point: the Stanbic IBTC Money Market Fund returned 21.22 percent year-to-date as of January 2025, surpassing the 91-day T‑Bill benchmark of 18 percent. Dollar mutual funds also play another role—FX protection. According to Nairametrics Research, 34 dollar-denominated funds delivered a 6.73 percent year-to-date return as of June 2025, down from 7.63 percent the previous year—still a useful hedge. A reasonable slice to allocate to mutual funds—depending on your liquidity needs and risk tolerance—might be 15 to 25 percent, allocated across naira yield funds and dollar-equivalent funds.

Exchange-traded funds are another medium-risk option that provide low-cost, diversified access to specific sectors or indexes. Nigeria’s NGX lists twelve ETFs, including the Vetiva Banking ETF (a proxy for the banking sector), Vetiva Industrial ETF, and NewGold ETF (physical gold exposure). The Vetiva Industrial ETF delivered 6.52 percent month-on-month, 5.51 percent quarter-on-quarter, and 2.12 percent year-to-date as of June. While ETF yield reporting can lack consistency in Nigeria, allocating 10 to 15 percent of a portfolio to ETFs provides exposure diversification, low fees, and targeted sector plays—especially for moderate-risk profiles.

Currencies and commodities serve as strategic inflators or hedges—not income generators. Dollar-denominated investments, whether via domiciliary or dollar mutual funds, offer limited yield unless invested in dollar bonds. Commodity instruments like gold or oil-linked equities give hedges against inflation and naira depreciation. Gold has been trading near $2,400 per ounce year-to-date; oil investments remain volatile but cyclical. As a trade-off, consider 5 to 10 percent allocations to such instruments as “satellites”—small holdings meant to buffer against adverse macroeconomic shifts.

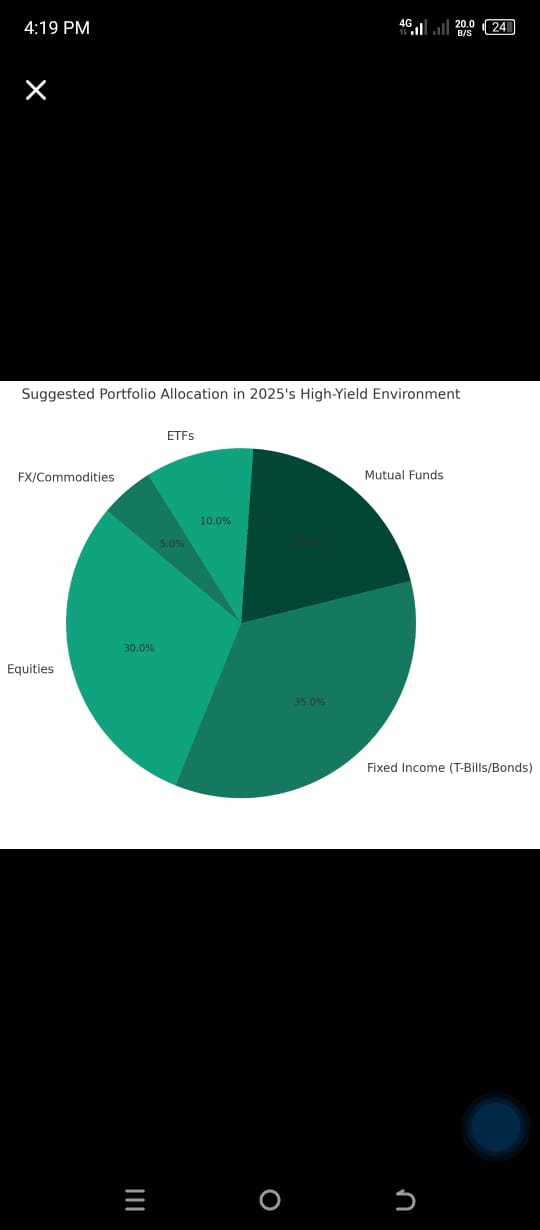

These proposed allocations offer a balanced blueprint, but the ideal mix depends on individual circumstances—particularly risk appetite, investment horizon, income requirements, and return objectives. For instance, if you target a 35 percent annual return, your portfolio must tilt more heavily toward high-return assets—but be ready for greater volatility. Split between equities, ETFs, and maybe even cryptocurrencies, such a portfolio demands periodic rebalancing.

Striking the right balance also means adjusting allocations dynamically. If inflation shows signs of moderating, shifting more toward equities may make sense. Should interest rates hold steady or rise, fixed income options become more attractive. If volatility spikes, safe assets provide a cushion. If the naira weakens rapidly, dollar positions can protect purchasing power.

In short, beating inflation in Nigeria’s market is not about chasing returns blindly—it’s about building smart, diversified portfolios that harness the strengths of different assets. Investors must aim for positive real returns, but understand that every asset class carries its own trade-offs.

At the end of the day, the smartest question an investor can ask isn’t “How much can I make?” but rather, “How smartly can I make it, given the risks?” A well-designed portfolio today might include equities for growth, fixed income for stability, mutual funds for professional diversification, ETFs for sector bets, and a touch of FX or commodities for protection. Combined, this multi-asset approach allows you to manage risk, capture opportunities, and most importantly, stay ahead of inflation’s bite