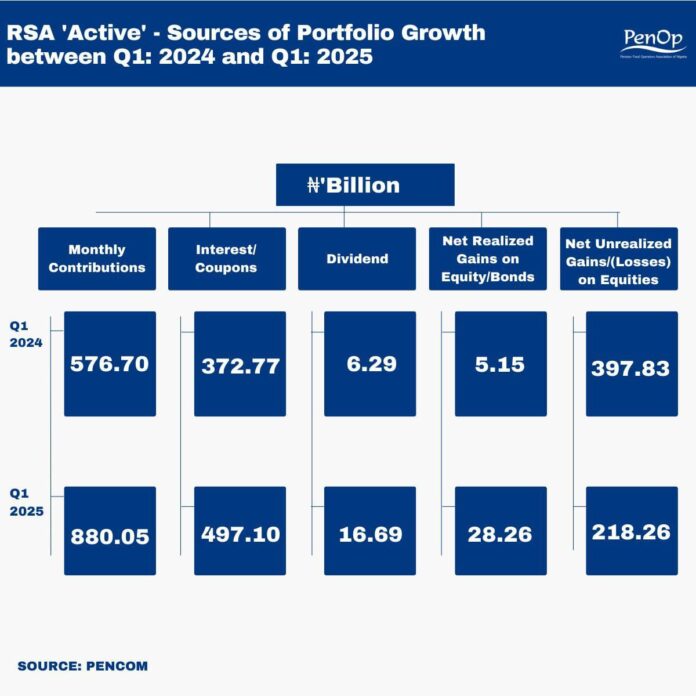

The composition of Nigeria’s pension fund inflows saw a notable shift between Q1 2024 and Q1 2025, as contributions became a more dominant driver of growth. Monthly contributions surged from ₦576.70 billion in Q1 2024 to ₦880.05 billion in Q1 2025, reflecting better compliance with the Contributory Pension Scheme, salary increases across public and private sectors, and modest growth in the formal workforce.

Interest and coupon payments also increased from ₦371.77 billion to ₦497.10 billion, benefiting from high-yield government and corporate debt securities, which provided pension funds with a more consistent and predictable income stream. Dividend inflows more than doubled, rising from ₦6.29 billion to ₦16.69 billion, largely due to stronger corporate earnings in banking and telecoms, while realized gains jumped from ₦5.15 billion to ₦28.26 billion.

However, net unrealized gains fell sharply from ₦397.83 billion to ₦218.26 billion, signaling reduced equity market revaluations.

Analysts note that Q1 2025 inflows reflect a strategic pivot toward stability, relying on steady contributions and fixed-income earnings rather than volatile market gains.