By David Okon

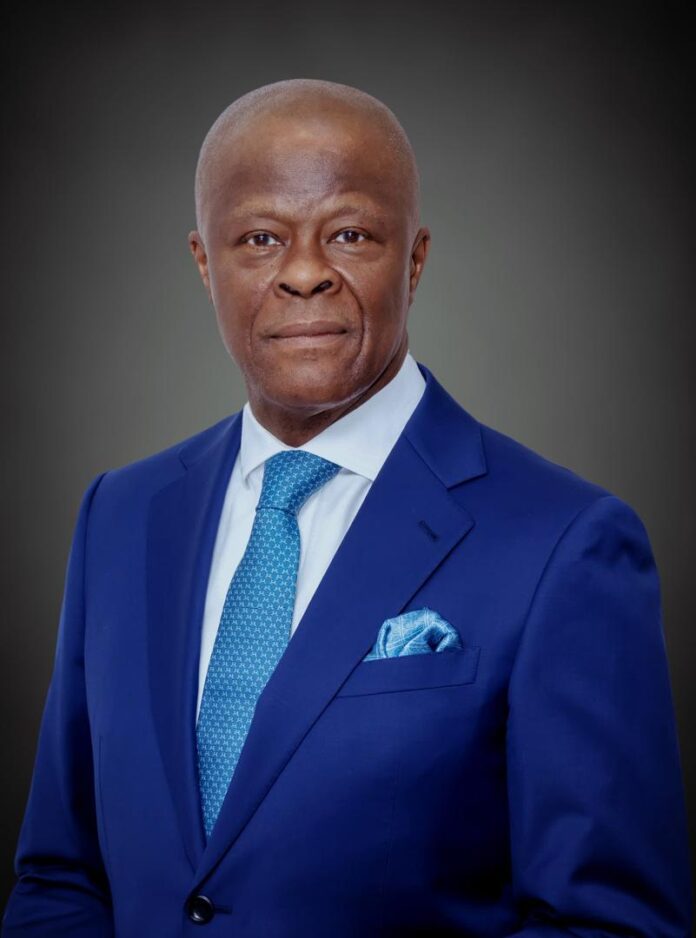

Nigeria’s economic story in 2025 was not defined by a single reform or headline-grabbing moment. Instead, it unfolded through careful sequencing — a deliberate effort to stabilise the macroeconomy, restore institutional credibility, and align security, fiscal, and market policies toward sustainable growth. At the centre of this approach was the Minister of Finance and Coordinating Minister of the Economy, Wale Edun, whose emphasis on reform discipline, capital mobilisation, and security has increasingly shaped investor perceptions of Nigeria.

The year opened with a focus on rebuilding the analytical foundations of economic planning. In early 2025, Nigeria completed a long-awaited rebasing of its Gross Domestic Product to a 2019 base year. Led by the National Bureau of Statistics (NBS), the technical exercise expanded the measured contribution of services, ICT, and the informal economy. The rebasing placed nominal GDP at approximately ₦372.8 trillion — equivalent to about $240–250 billion — offering policymakers and investors a clearer picture of the economy’s true structure and scale.

That reset proved consequential. It informed the fiscal decisions that followed, including tighter expenditure controls, reforms in tax administration, and closer coordination with monetary authorities to rein in inflation and stabilise the foreign-exchange market. By the fourth quarter of 2025, inflation — which had exceeded 24 per cent earlier in the year — began a steady decline, reaching about 14.45 per cent by November. Foreign reserves strengthened toward $47 billion, reinforcing external buffers and signalling improved balance-of-payments management. These trends were noted by multilateral institutions, including the World Bank and Afreximbank, in their 2025 outlooks for Nigeria.

By mid-year, the reform narrative shifted from stabilisation to confidence, most visibly reflected in Nigeria’s capital markets. The Nigerian Exchange closed 2025 as one of Africa’s best-performing bourses, with the All-Share Index up roughly 49 per cent year-to-date by late December. Total market capitalisation across equities, debt instruments, and ETFs rose to nearly ₦150 trillion, driven by strong corporate earnings, bank recapitalisation, and new listings, according to NGX Group Chairman, Umaru Kwairanga.

Banking-sector reform was central to this momentum. As part of recapitalisation efforts designed to strengthen financial stability and credit transmission, Nigerian banks raised an estimated ₦2.5 trillion in fresh capital by December 2025 through rights issues, private placements, and public offers, based on NGX filings and Securities and Exchange Commission approvals. The capital injection reinforced balance sheets and helped fuel the broader market rally, highlighting the link between prudential reform and investor confidence.

Debt markets mirrored this trend. Between April and October 2025, companies raised over ₦753 billion through commercial paper issuances to finance short-term working capital, reflecting growing depth and confidence in Nigeria’s fixed-income market.

Energy and industrial policy formed the next layer of the reform arc. The Dangote Refinery, already operating at 650,000 barrels per day, confirmed plans to expand capacity to 1.4 million barrels per day. Analysts say the expansion could significantly reduce fuel imports, ease pressure on foreign exchange, and improve Nigeria’s trade balance. The refinery has become emblematic of the government’s drive to support large-scale domestic production as both an import substitute and a magnet for global capital.

At the national level, NNPC Ltd continued its post-commercialisation transformation. Group Chief Executive Officer, Bayo Ojulari, said operational improvements reflected deeper structural reforms, noting that oil production rose from about 1.5 million barrels per day in 2024 to over 1.7 million barrels per day in 2025. He also underscored the strategic importance of the 614-kilometre Ajaokuta–Kaduna–Kano (AKK) gas pipeline, designed to transport 2.2 billion standard cubic feet of gas per day and unlock industrial growth across northern Nigeria. Ojulari added that NNPC’s focus for 2026 includes attracting new investments, increasing output to at least 1.8 million barrels per day, and supporting President Bola Tinubu’s directive to mobilise $30 billion in energy investments by 2030.

Infrastructure and future-facing sectors rounded out the reform story. Progress continued on the Lagos–Calabar Coastal Highway, with approximately $1.126 billion secured by the Ministry of Finance and the Economy for Phase 1, Section 2 of the project. President Tinubu described the financing as a major milestone, noting that it would allow construction to proceed without interruption while signalling the administration’s commitment to unlocking funding for priority economic infrastructure nationwide.

Port decentralisation initiatives in southern Nigeria, alongside digital-skills programmes under the Ministry of Communications, Innovation and Digital Economy — including the 3 Million Technical Talent (3MTT) initiative led by Minister Bosun Tijani — complemented the infrastructure push. Meanwhile, the creative economy, spanning film, music, fashion, and digital content, continued to grow as a source of jobs, exports, and soft power, gaining increasing recognition as a strategic economic asset.

The most delicate test of investor confidence came in the final week of the year. On December 25, US forces carried out targeted airstrikes against Islamic State-linked camps in Sokoto State, in coordination with Nigerian authorities. The government moved swiftly to contextualise the action within a broader stability framework. In a statement on December 28, Wale Edun emphasised that “security and economic stability are inseparable,” describing the operation as “precise, intelligence-led, and focused exclusively on terrorist elements that threaten lives, national stability, and economic activity.” He stressed that Nigeria “is not at war with itself or any nation,” but is confronting terrorism alongside trusted international partners — a message clearly calibrated for markets and multilateral stakeholders.

That framing captured the essence of Nigeria’s 2025 reform narrative: security not as a standalone military issue, but as an economic input and a prerequisite for investment.

As Nigeria enters 2026, risks remain, but the direction is clearer. The proposed ₦58.18 trillion federal budget for 2026, anchored on revenue mobilisation, infrastructure spending, and deficit restraint, suggests an effort to consolidate gains rather than reset strategy. For investors, the signal from 2025 is not one of perfection, but of coherence — with policy, security, and markets increasingly moving in the same direction.

For an economy long characterised by stops and starts, that alignment may prove the most valuable reform of all.

David Okon is a marketing communications and policy consultant at Quadrant MSL, part of the Publicis Groupe and Troyka+Insight Redefini Group.